2019 has already knocked our front door. Now it’s time to put on the prognosticator head and forecast the retail trends that will shape the industry in the brand new year.

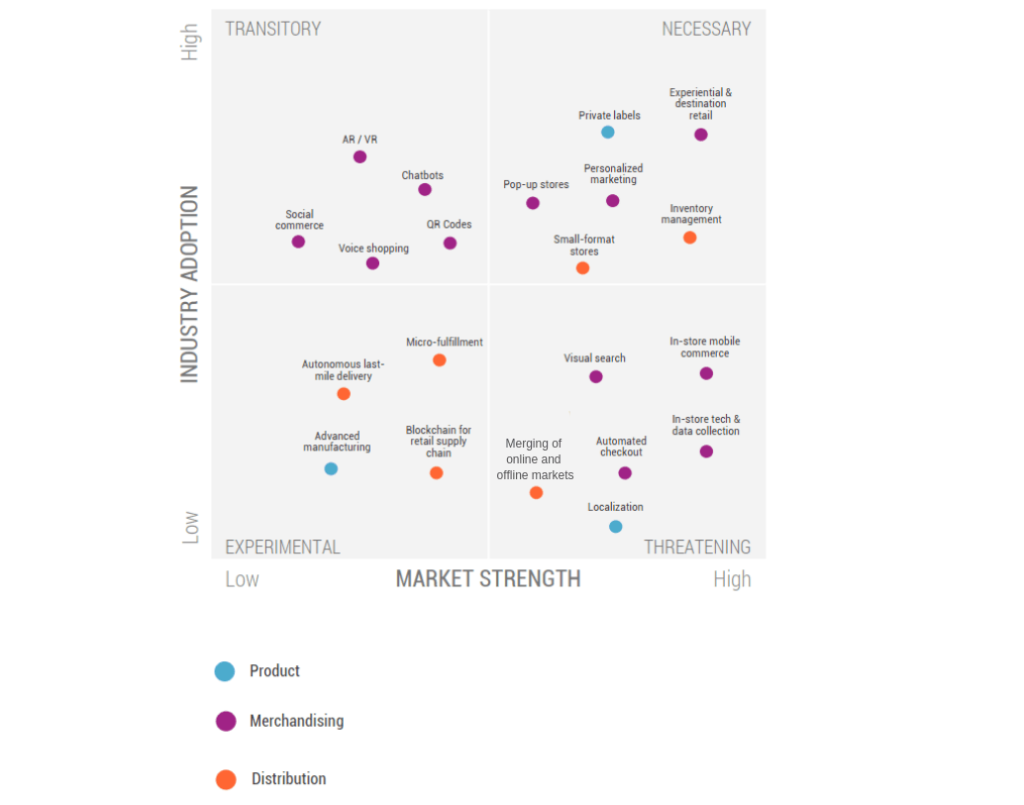

There are a lot of articles talking about the retail trends 2019, but this one is different. By using the NExTT framework by CB Insights, we will look at industry adoption and market strength to categorize emerging retail trends as necessary, experimental, threatening, or transitory. This is to make sure that you don’t miss any of the trend, and that you can critically evaluate and efficiently allocate your resources to prepare for the trends.

Overview

Necessary trends

First let’s take a look at Necessary trends. These are the trends which are seeing high industry and customer adoption and where market and applications are well understood. For these trends, incumbents should have a clear, articulated strategy and initiatives.

#1 Private labels

If you walk down the aisle at ALDI, you may notice that there are only few well-known brands on shelves. Why? Because 90% of ALDI’s products are now private labels, or so-called store brands. This is the strategy that has put Aldi on track to become the third largest grocery retailer in the US by 2022, after Walmart and Krogger.

The first advantage of using private labels is to cut out third-party brands, thus allow retailers to easily control over the production costs – a key advantage to compete in a business with razor thin margins. Lower production cost means lower price for consumers as well, so for discount retail chain like ALDI, this strategy just totally fits.

Beyond margins and pricing, private labels also enables retailers to easily cater for consumers trends across products, which in turn and build greater consumer loyalty for in-house brands. Given the advantages of private labels, brick-and-mortar retailers like Albertsons, Walmart and Target have all poured their investment in private label offerings last year. Albertsons has been on track to launch 1,400 new private label products over the last 2018, while Walmart also aims to boost its private label growth by launching the wine private label “Winemakers Selection| in June 2018.

#2 Experiential retail

The old model of brick-and-mortar (and even online) store restrictedly focuses on products being sold. But nowadays, customers have been slowly but surely moving from buying products to seeking an engaging shopping experience. Therefore, physical stores are becoming the destination to offer customers various experiences and activities.

►►►► Please visit our products: digital banking, situation analysis, Shopify markets, supply chain operations management, fintech ai, Multi Store POS, Woocommerce POS, Mobile POS, White label POS, Reseller POS, Beauty Supply Store POS, POS System for Retail and Vape shop POS

This can be an experience to increase brand awareness. For example, a mattress startup Casper opened its Dreamery store in New York City in July 2018 where customers can pay $25 to take a 45-minute nap in a private area on a Casper mattress. Caster believes that having a store focused on experience (instead of transaction) will promote sales by increasing brand awareness. Nordstrom is also focusing on creating experience by opening a small format Nordstrom Local locations in the Los Angeles area which has no inventory, but instead offer tailoring and alteration services, online order pickup and personal stylist consultations.

#3 Smaller-format stores

Major retailers are continuing to shy away from traditional large stores, opting instead for downsized city-center stores that caters for increasingly urbanized consumers. IKEA shows us how to get bigger by getting smaller by recently announcing the upcoming launch of a “studio” store in Manhattan in Spring 2019, which would act as a “planning studio” where customers can select items they would like to be delivered to their homes. Going forward, we may see that these smaller-format stores can leverage their urban location to aid in online order fulfillment and delivery. They can also partner with fulfillment startups to increase the speed of last-mile delivery to consumers.

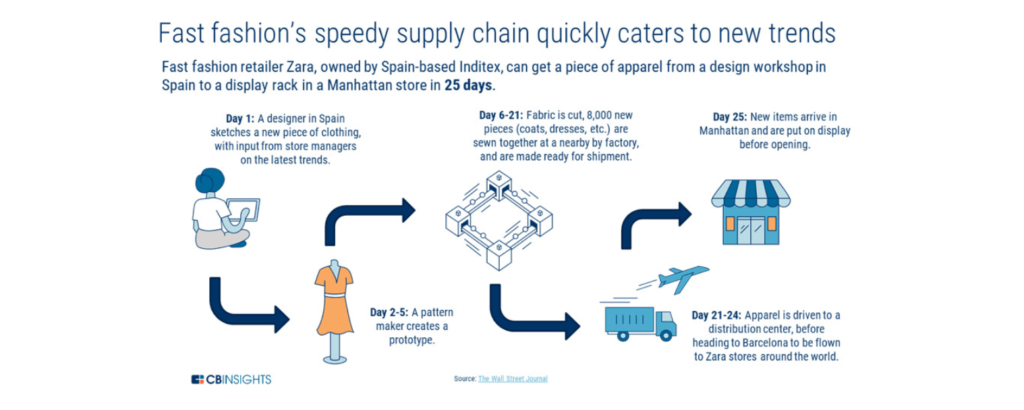

#4 Inventory Management

Zara is among the first retailers that have created the “fast fashion” trend. The retailer can design, manufacture, ship and sell new apparel in under 25 days. This success emphasizes the importance of a strategic, technology-driven inventory management strategies.

In another example, Target is testing faster inventory replenishment cycles to its small-format stores across New York city. The new system reduces overall inventory held in stores by only replenishing supplies as needed. Target believes that with less inventory in the back of the store, they can dedicate more floor space toward online order fulfillment and packaging”. An ecosystem of startups are leveraging software, data, AI, IoT, and more to manage inventory for retailers. These include Relex and Vekia, which provide inventory and supply chain management software platforms, as well Happy Returns and Optoro, which help optimize returns logistics.

#5 Pop-up stores

Pop-up stores are quickly proliferating across the retail industry, acting as a canvas for retailers to test out new types of products, technologies, services, brand campaigns and store layouts. Traditionally, the pop-up store phenomenon has been the domain of digitally native brands looking to experiment in physical retail. Bonobos, for example, operates a mobile trailer pop-up store where customers can try on different outfits with the help of a stylist, to be ordered online and delivered to their homes.

However, pop-up stores are going even beyond digitally native B2C startups, to become a staple for all types of retailers even Alibaba or Amazon. For example, Alibaba opened 60 pop-up stores for Single Day 2017 through its online marketplace Tmall. The pop-up stores takes advantages of AR (Augmented Reality) to create “magic mirrors” which allow customers to virtually try on clothes.

#6 Personalized Marketing

Customers also want to receive something special and exclusively designed for them. Nowadays, given the vast amount of data that retailers can capture on their customers via mobile apps, Ecommerce or in-store technology, retailers can have chance to reach customers in a highly personalized way.

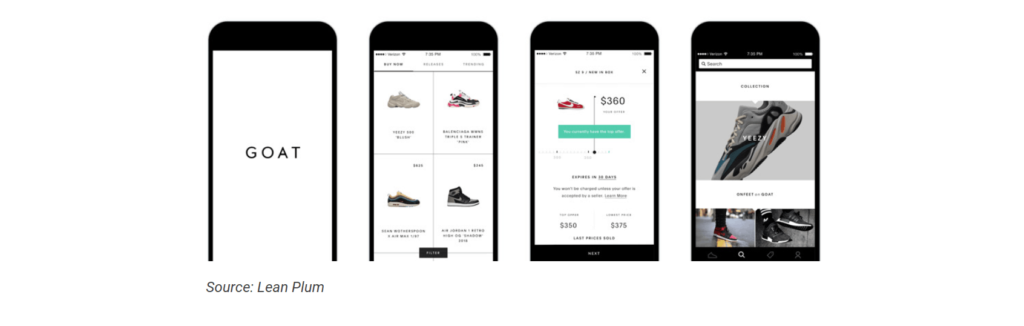

Online sneaker marketplace Goat offers a special kind of personalized marketing. Customers can create a wish list of sneakers, and customize a price point which they are willing to buy. If a pair of sneakers on customers’ wish list goes on sale, or if its price drops within 5% of the personalized price margin, customers may receive a push notification from Goat.

In another example, Sephora has leverage customer data obtained from in-store technology like ColorIQ, which scans customers’ skin to get the information such as skin type or tones. This data is saved to personalize digital marketing going forward.

Transitory trends

Now let’s move to transitory trends. Similarly to necessary trends, transitory ones do see high industry adoption, but there is still uncertainty about market opportunity. As transitory trends become more broadly understood, they may reveal additional opportunities and markets.

#7 Augmented Reality (AR) and Virtual Reality (VR)

Retailers are taking advantages of AR (Augmented Reality) and VR (Virtual Reality) which have already shown their potential in 2018 with many famous brand such as IKEA, Samsung, or Amazon. These technologies help customer to view and try products on their devices before making decisions to buy. AR and VR can bring real customer experience especially for online retails who are selling home decors, furniture, clothes, cosmetics, etc.

In another example, Alibaba partnered with Starbucks to construct a 30K square foot mega-store in December 2017. The store integrates AR technology into the coffee-buying process: customers can learn about the coffee-making process and available products through an Alibaba powered augmented reality app.

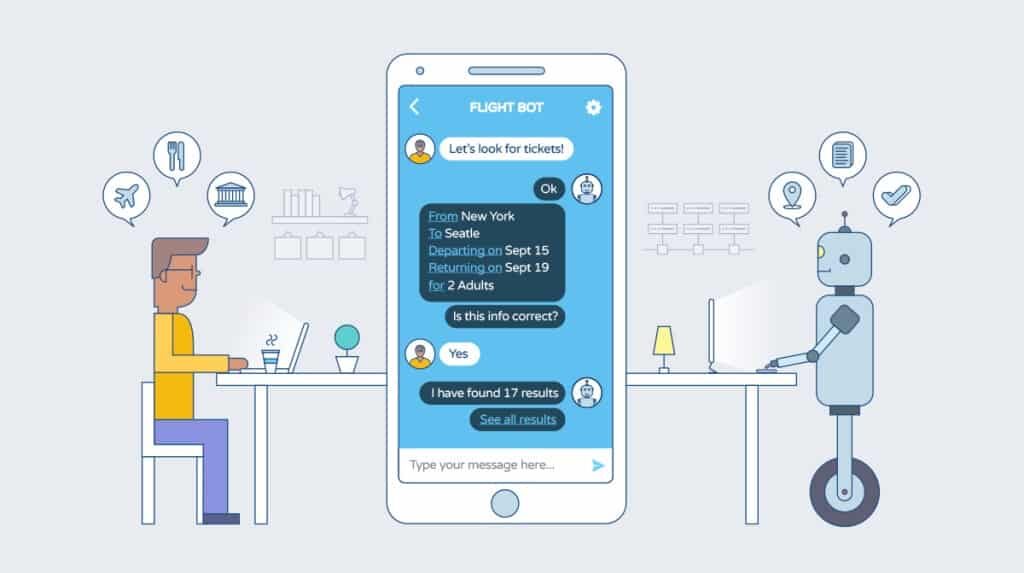

#8 Chatbots

Retailers could save significantly on customer service costs by using chatbots and convincing customers to use them as well. In 2018, Nike partnered with Facebook Messenger bot to sell a pair of Kyrie Irving signature shoes. To gain access to the shoes, customers had to open the messenger app and chat with Nike’s SNKRS bot. The sale was a success, with the sneakers selling out within minutes.

In 2019, the modern chatbots with AI integrations will help to improve conversion rate significantly. They can talk to customer under different scenarios naturally by the pre-configurations to consult, qualify leads, and close deals, as well as to collect accurate insights for merchants to make right decisions.

However, chatbots still face obstacle to customer adoption since 70% of consumers still prefer human-to-human interaction according to a recent study by the Sitel Group. Therefore, to leverage this technology, chatbots need to be integrated more deeply with AI to mimic human interaction and customize talks to customers under different scenarios.

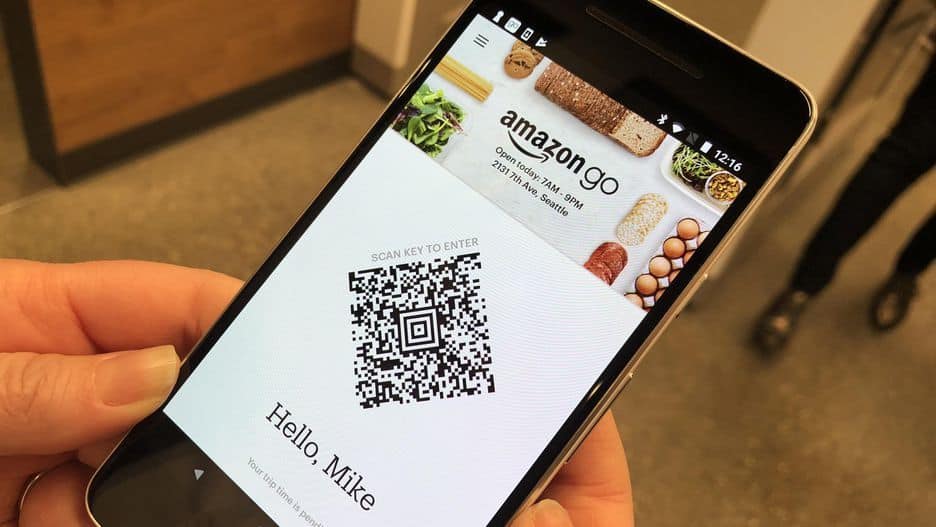

#9 QR Codes

QR code scanning has become an integral part of the physical stores. Amazon has built cashier-less retail store (called Amazon Go) where customers are identified by scanning QR code as they walk in. At Nike’s new tech-enabled stores, using Progressive Web App technology, customers scan QR codes on items or mannequins to learn more about the items. Retail tech company Ombori recently partnered with Microsoft and Swedish home retailer Clas Ohlson to unveil a QR-code powered interactive window display. Equipped with motion sensors, the display awakens when someone walks by. When a person scans the QR code on the screen with his phone, he can use his smartphone to browse the contents of the store before walking in.

#10 Voice shopping

By now e-commerce is a still very visual experience, but “voice ecommerce” rises as a new term. Huge development of voice technology allows people to search, select and purchase by talking with their devices and it is used by 41% customers of Amazon Echo and Google Home in the 2017. And there will be 50% of total searchers will use voice search in 2020.

Voice shopping might be better suited for replenishing everyday household goods that require little research on the consumer’s part before buying. Some estimates still suggest that Alexa could bring in $5B in revenue through voice shopping by 2020, according to RBC Capital Markets. In December 2018, Alibaba unveiled a new voice assistant for logistics company Cainiao. The voice assistant is meant to help manage orders and deliveries, and is able to successfully navigate conversational obstacles such as interruptions, and non-linear speech — something that has previously been difficult for voice assistants to handle.

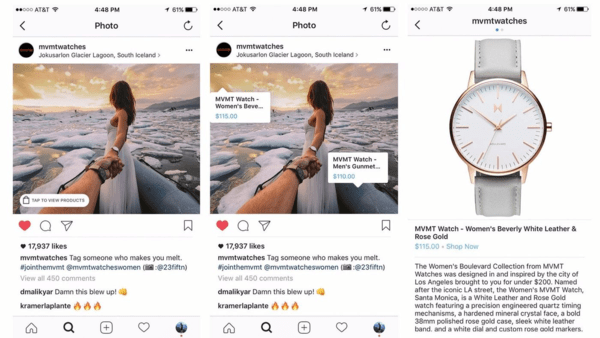

#11 Social commerce

Social commerce, or social shopping, is the inevitable meeting point of social media and commerce. Consumers are heavily influenced by social media in making purchase decisions, but they have been slowly taking to social shopping. For example, some may talk with a friend on Facebook about an item, and then buy it on Amazon. Social media and commerce used to be seen as separate activities. But things have changed now, with as many as 30% of consumers now saying they’d make a purchase on major social platforms like Instagram, Twitter, Snapchat or Facebook. One of the first and most popular ways to turn social media into a sales channel is the “Buy now” button that now can be commonly seen on big social networks including Facebook, Twitter, Instagram and Pinterest. The top 500 retailers brought in $6.5B in social commerce revenue in 2017, up 24% from 2016, according to Adweek. So surely this is a not-to-miss trend to investigate further for your retail business in 2019.

Subscribe and stay updated with our 2019 retail trends (part 2)

Source: CBInsights