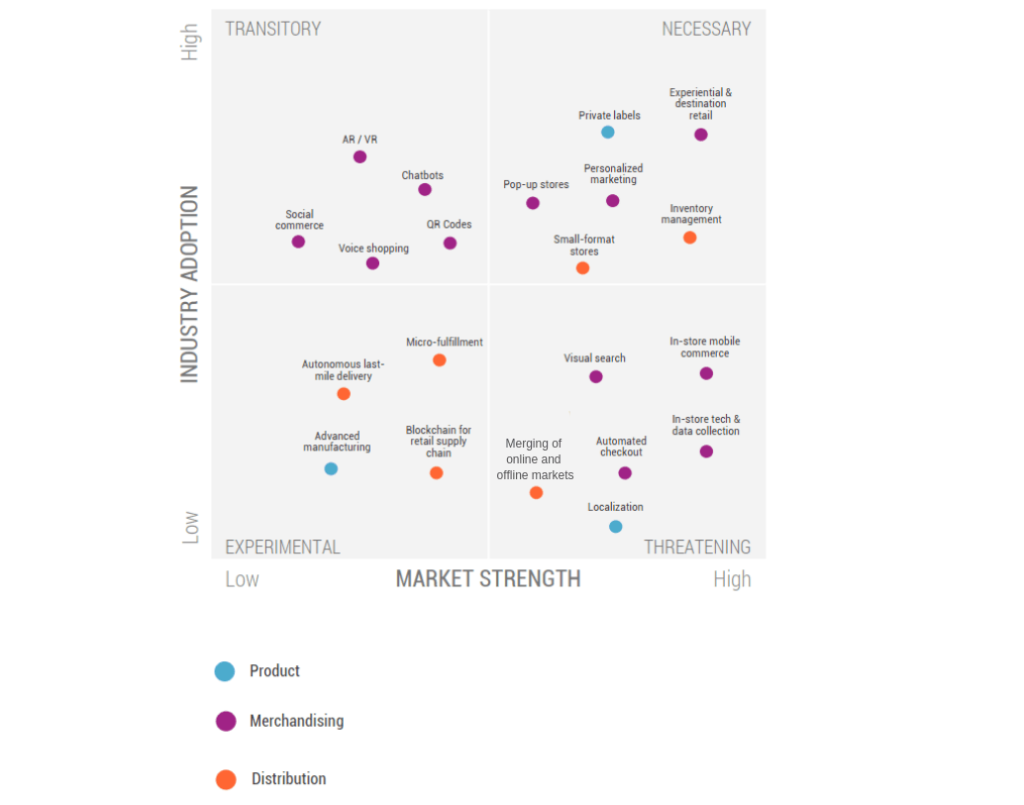

Before we continue, make sure you have checked the Part 1 to get the first 11 retail trends predicted to shape 2019 industry. At Part 1, we went through the necessary and transitory trends which all have high industry adoption. Let’s continue with experimental and threatening trends.

Overview

Experimental trends

Although spurring the media interest and proof-of-concepts, experimental trends are relatively conceptual at early-stage, and are mainly applied to few functional products insteads of broad industry adoption.

#12 Micro-fulfillment

New micro-fulfillment startups are leveraging software, AI and robotics to operate small urban warehouses and fulfill online orders. By placing warehouse in urban areas near consumers, retailers can speed e-commerce fulfillment and reduce last-mile delivery costs. An example of micro-fulfillment success is the partnership between grocery retailer Albertsons and warehousing robotics startup Takeoff Technologies. Similarly, Israel-based CommonSense Robotics, within the collaboration with Israel’s largest drugstore chain Super-Chain or other 5 US grocery retailers, also develops its micro-fulfillment technology by building robotic technology to operate in small urban warehouses.

Along with a rise in micro-fulfillment, retailers globally are also paying more concern about warehouse automation, or so-called smart warehouse. For example, in June 2018 China-based JD.com unveiled its 100,000 square foot smart warehouse that employs only 4 people. The warehouse takes advantages of AI, robotics and image scanners to sort up to 16,000 package per hour.

#13 Blockchain for retail supply chain

Blockchain can provide greater supply chain transparency for retailers. Since 2017, Walmart has worked with IBM’s Food Trust blockchain platform to improve food tracking and safety. The Food Trust can track the source of food from days, weeks, or months within only 2.2 seconds via blockchain and distributed ledger technology. Similarly, there are a growing number of retailers exploring blockchain through their own pilots such as ABInBev and Accenture with tracking beer shipments, or IBM and Helzberg Diamonds with verified jewelry sourcing.

Another benefit of leveraging blockchain is to coordinate shipments for goods across the globe. By connecting all supply chain players on a transparent and secure digital ledger where all players can communicate, blockchain can help to increase shipment visibility while reduce delay and fraud. However, the condition to leverage above benefits of blockchain is that all players in the supply chain have to operate on the same distributed ledger platform. To overcome this, Tradelends, a joint venture between IBM and Maersk, was developed as a tool of standardization which can integrate dozens of global supply chain players on a unified platform.

#14 Autonomous last-mile delivery

Last-mile delivery costs businesses more than $86B globally in 2017, according to McKinsey, and can make up 28% of a good’s total transportation cost. Especially for thin-margin businesses like grocery retail, retailers are constrained by the cost of paying delivery drivers, which often causes the price tag of grocery delivery to become prohibitively expensive for mass consumers. One strategy that retailers like Kroger and Domino’s are piloting to cut down cost of drivers is by using autonomous vehicles (AV).

►►►► Please visit our products: digital banking, situation analysis, Shopify markets, Vietnam Photography Tour, Photography Tour Guide Viet Nam, supply chain operations management, fintech ai, Multi Store POS, Woocommerce POS, Mobile POS, White label POS, POS Reseller, Beauty Supply Store POS, Retail POS and Vape shop POS

If autonomous ground delivery is successfully piloted, the future retail may witness direct investments or acquisition of AV startups by major grocery retailers going forward.

#15 Advanced manufacturing

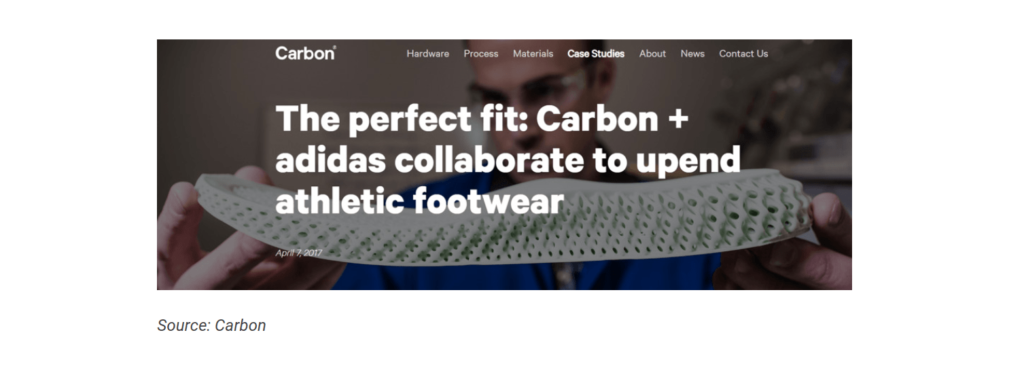

Advanced manufacturing is a future where retailers can not only manufacture much faster but also customize apparel on-demand much better. For example, Adidas’s new Speedfactories has helped bring the entire shoe making process under one roof in order to produce shoes only within days. The facilities at Speedfactories also leverage digitally automated machinery like 3D printing, robotic arms, and computerized knitting. This significantly reduces the production time and the need for manual labor. Moreover, the company is also using its Speedfactories as a testing ground for individualized customization, such as 3D printing or creating carbon-printed insoles, to tailor to individual consumers on-demand and at scale.

Similarly, Nike and Brooks Running have also explored 3D printing as a tool of customization. Even Amazon has jumped into advanced manufacturing field by introducing a system for robo-cutting fabrics into any shape, form or pattern specified in customers’ order. This is to raise customers’ interest in Amazon’s private-label clothes brands.

Threatening trends

These are the trends which have witnessed large addressable market forecasts and notable investment activity. Threatening trends have been embraced by early adopters and may be on the precipice of gaining widespread industry or customer adoption.

#16 In-store technology and data collection

There are a lot of examples of in-store technology, ranging from skin tone scanners to interactive digital displays or facial recognition platforms, which are not only fun and effective in enhancing customers’ experience, but also a valuable tool to gather customer data for personalized marketing. Sephora uses ColorIQ technology to scan customers’ skin tone and saves this data for personalized products recommendation. Another example is interactive digital displays of startup Perch which specifically offers displays that track in-store customer interaction with products visa IoT and computer vision technology. Giant China-based Alibaba has partnered with Face++ to unveil facial recognition-based payments called smile-to-pay technology.

#17 Merging of online and online markets

The offline and online worlds continue to merge with Walmart continuing to expand their online purchase and create a partnership/acquisition of a major online retailer while Amazon does the same with a major offline retailer (such as Best Buy or Target). Retailers are leveraging existing physical real estate as online fulfillment centers to support growing e-commerce businesses. For example, Zara has integrated a stock management system that uses RFID garment tracking technology at stores across 25 markets to support same-day delivery for online purchases.

Giant Internet-based Alibaba has even taken to concept of stores as fulfillment centers to an entirely new level. Ahead of the busiest shopping time of the year – Single’s day 2017, Alibaba recruited more than 600,000 Chinese mom-and-pop stores, which accounts for 10% of all such store in China to install its store management app called Ling Shou Tong and act as delivery and fulfillment centers for goods ordered online. This app helps store owners to stock popular items beforehand and also helps Alibaba to track in-store consumer spending. This is a sign of the future of retail where the boundaries of online and offline markets are gradually blurred.

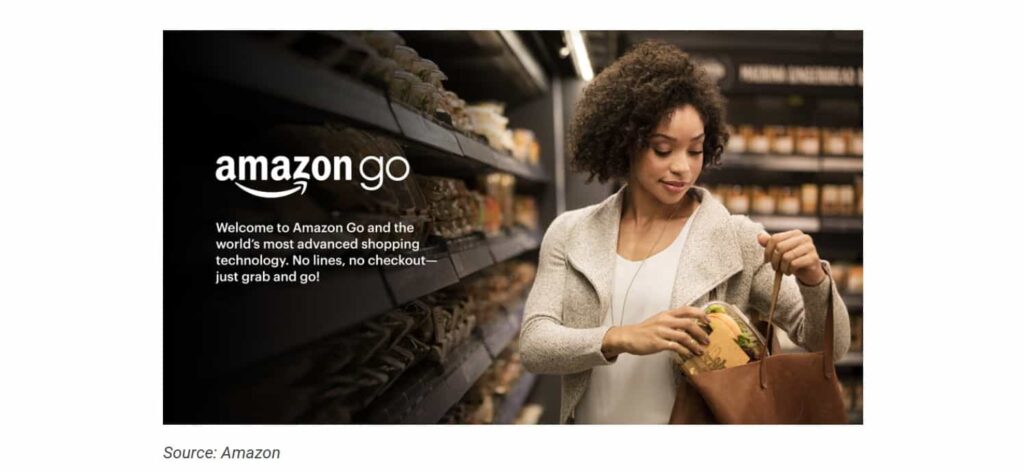

#18 Automated checkout

While large internet companies like Amazon and Alibaba are leaders on deploying this technology to their physical retail locations, emerging startups could help democratize access for all retailers. Amazon has opened several Amazon Go locations in cities like Seattle, San Francisco and Chicago, and is planning to expand the Amazon Go network to more than 3,000 locations across the US by 2021.

Other retailers are also working on ways to take cashiers out of retail, by encouraging self-service technology such as Progressive Web App or Self-service kiosks. China’s second largest e-commerce platform JD.com opened its first human free convenience store in Shandong, China in January 2018. So far JD.com has operated more than 20 unmanned stores in China. Although the cashier-less trend continues to attract a lot of attention, more model and case studies are needed to prove that these stores can still operate smoothly and consistently at larger scale.

#19 Localization

In an attempt of localization, retailers are tailoring their inventory to fit with store location demographics. Target is an example of an early adopter of localization via its small-format stores across the US. Stores located in a neighborhood with many families will stock more family-related and children items, while those in culturally diverse areas may stock a wider range of food options. Target also opens small-format college campus stores to particularly serve the needs of students especially those living in campus. In order to successfully localize, Target conducts community-based research to better understand local people’s need and taste, and that means they can adjust the assortment and services to fit regional and demographic needs.

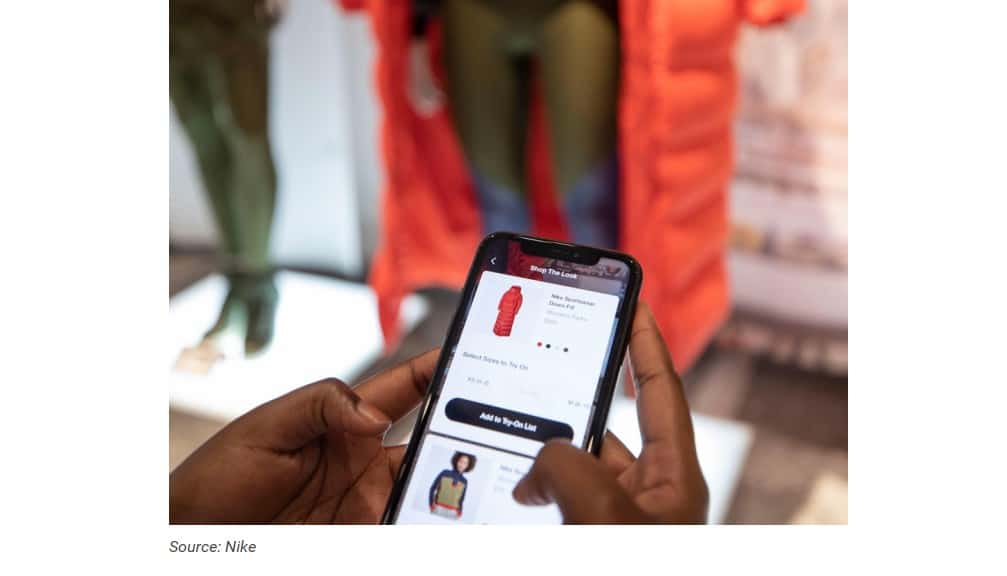

#20 In-store mobile commerce

Mobile commerce is obviously instrumental in e-commerce, but is also becoming a strategic tool in enhancing the brick-and-mortar experience. For example, at Nike store in New York city, customers that have joined Nike membership program and have downloaded Nike mobile app can benefit from various in-store services such as: instant checkout using Nike app, “Shop-the-look” which allows customers to scan in-store mannequins with their phones and get information of the entire outfit, “in-store pick-up lockers” which enables customers to reserve items via their mobile phones and come to the store at their convenience to pick them up.

However, not everyone succeeds to streamline the use of mobile phone in their brick-and-mortar stores. Walmart, for example, had to let go of its mobile Scan & Go program in May 2018 due to low customer’s adoption.

In practice, mobile integration may suits some certain types of retail better than others. Regardless, we can expect retailers and technology startups to explore more ways to leverage the use of mobile in physical stores, in order to create the best convenience for customers.

#21 Visual search

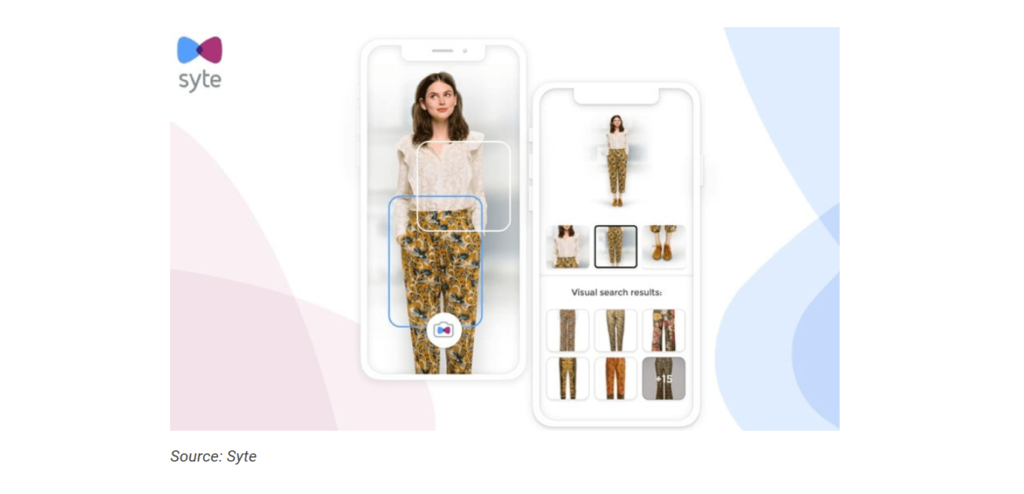

A growing number of retailers are taking advantage of computer vision technology to explore visual search. For example, luxury online fashion marketplace Farfetch recently unveiled the visual search service on its iOS mobile app. Customers can upload photos of products they come across in life (on the street, online, or through a friend) in the app, and they will be recommended with the same or similar products by Farfetch.

To do so, Farfetch has partnered with Israel-based startup Syte. The platform uses computer vision to provide visual search and image recognition capabilities. Syte focuses on the apparel space, an area notoriously difficult to apply visual search due to subtle differences in clothing material and fabric.

As visual search adoption continues to gain traction, we’ll begin to see new retailers jump on the visual search bandwagon, either through partnerships with relevant startups in the space (like Syte) or through in-house development.

Source: CBInsights